In The Year of Less, Cait Flanders shares her personal story of struggling with consumerism, debt, and unhappiness. Feeling overwhelmed by her possessions and the constant desire for more, she embarks on a year-long experiment to limit her spending and declutter her life

Siegel offers practical advice and insights on a wide range of financial topics, including budgeting, saving, investing, debt management, insurance, and retirement planning. The book is written in a conversational and easy-to-understand style, making it accessible to readers of all financial backgrounds.

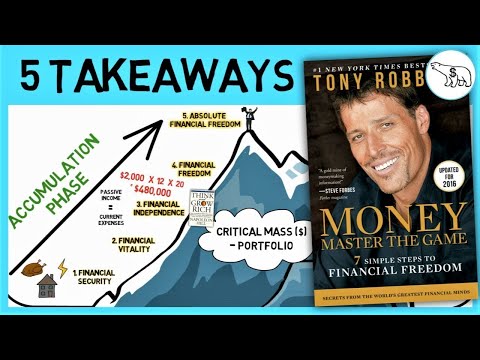

Master the Game by Tony Robbins is a comprehensive guide to personal finance and investing. It provides strategies and insights from some of the world's most successful investors and financial experts. Here is a summary of the key takeaways and actionable steps from the book:

Richer, Wiser, Happier by William Green is a compilation of insights and wisdom from some of the world's most successful investors and thinkers. Here is a summary of the key takeaways and actionable steps from the book:

The Wealthy Gardener" by John Soforic is a unique financial literacy book that presents financial principles through the metaphor of gardening. Here is a summary of the key takeaways and actionable steps from the book:

The Psychology of Money explores the complex relationship between money and human behavior. It delves into the psychological biases, emotions, and decision-making processes that influence our financial choices. The book provides insights into the importance of understanding our money mindset and developing a healthy relationship with money.

The book provides a six-week personal finance program for young adults to achieve financial success. It covers topics such as budgeting, saving, investing, and automating finances.

The book explores the traits and habits of ordinary millionaires. It shatters common misconceptions about wealth and highlights the importance of frugality, discipline, and long-term wealth accumulation.

The book provides guidance on value investing and developing a rational approach to stock market investing. It emphasizes the importance of analyzing stocks, understanding intrinsic value, and avoiding speculative behavior.

The book explores the power of mindset and positive thinking in achieving financial success. It emphasizes the importance of setting clear goals, creating a detailed plan, and taking consistent action.

Summary: The book shares Robert's upbringing with two dads - his real dad (poor dad) and his friend's dad (rich dad). It emphasizes the importance of financial education, understanding assets and liabilities, and building passive income streams.

“Any time you sincerely want to make a change, the first thing you must do is to raise your standards.”